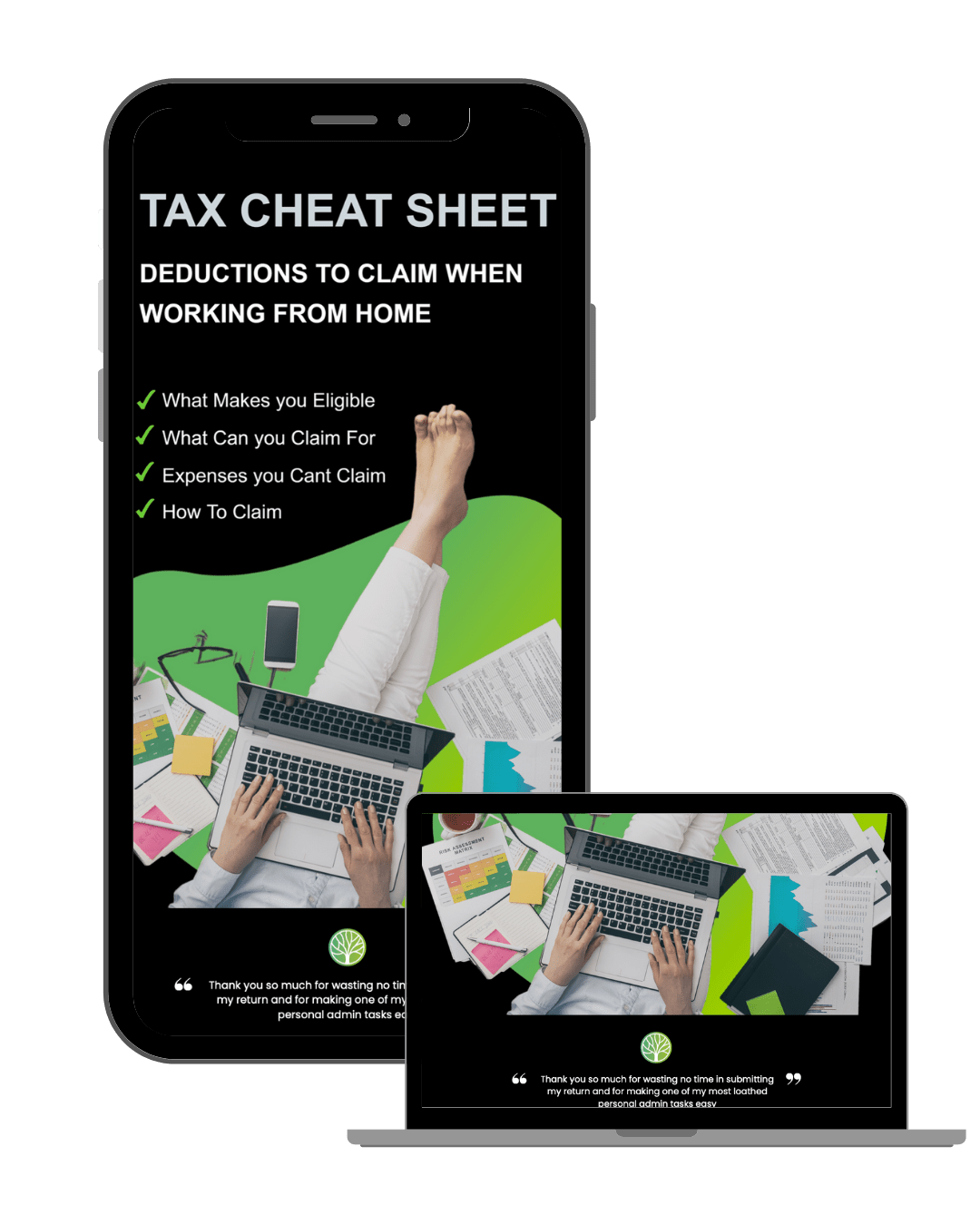

Working From Home Tax Deduction 2025. You can claim $2 for each day you worked from. However, even if you’re not one of these, there are still a few possible ways for you to get tax deductions from your expenses for working from home.

However, even if you’re not one of these, there are still a few possible ways for you to get tax deductions from your expenses for working from home. Before you know it, it will be tax time again.

6 Working From Home Deductions You Can Claim BOX Advisory Services, Calculate your allowable expenses using a flat rate based on the hours you work from home each month. Fill in the applicable form.

Home Office Tax Deduction What to Know Fast Capital 360®, Make new tax regime the default tax regime for the assessee being an individual, huf,. New cra rules around working from home make it harder to claim expenses.

2025 Working From Home Tax Deductions, Two ways to calculate a work from home deduction for tax time 2025. Working from home (wfh) tax deduction red oak, updated march 14, 2025 · 5 min read.

Work From Home Tax Deduction YouTube, Working from home (wfh) tax deduction red oak, updated march 14, 2025 · 5 min read. Two ways to calculate a work from home deduction for tax time 2025.

Working from Home (WFH) Tax Deduction Red Oak, Can you claim the home office tax deduction this year? This means you do not have to work out the proportion.

Working from Home (WFH) Tax Deduction Red Oak, You can claim for this tax year and the 4 previous tax years. The cbdt circular dated april 23, 2025 states:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Updated march 14, 2025 · 5 min read. Fill in the applicable form.

Work from home deductions Personal Tax Specialists, Working from home (wfh) tax deduction red oak, updated march 14, 2025 · 5 min read. Although there has been an increase in employees working at home since coronavirus, under tax reform, employees can no longer take federal tax deductions for.

Working from home tax deductions by Cornell Irving Partners, If you’ve worked from home during 2025, you might be able to claim the work from home tax deduction. You might claim a $1,500 deduction for qualifying workspace.

How To Work Remotely From Home 2025 Best Setup Tips And Tools, The home office deduction allows qualified. There are two different times to claim: